Small businesses are the backbone of our economy, and their success is vital for overall economic growth. Yet, one of the biggest challenges these businesses face is accessing the capital they need to grow, hire, and innovate. This is where the Minority Business Development Agency and the U.S. Small Business Administration's (SBA) 7(a) loan program comes in.

**### What Is the MBDA Program? ###**

The U.S. Department of Commerce, Minority Business Development Agency (MBDA) is the only federal agency solely dedicated to the growth and global competitiveness of minority business enterprises.

**### What Is the SBA 7(a) Loan Program? ###**

The SBA 7(a) loan program is the SBA's primary business loan program, aimed at providing financial assistance to small businesses. It offers loans that can be used for various purposes, including:

- Acquiring, Refinancing, or Improving Real Estate and Buildings: Whether you're looking to purchase a new property, expand your existing one, or refurbish your workspace, 7(a) loans can help.

- Short- and Long-Term Working Capital: Managing cash flow is crucial for small businesses. 7(a) loans can provide the working capital needed for day-to-day operations or long-term growth strategies.

- Refinancing Current Business Debt: If you have existing high-interest debt, you can use a 7(a) loan to refinance it, potentially saving your business money on interest payments.

- Purchasing and Installation of Machinery and Equipment: Upgrading your equipment can improve productivity and competitiveness. These loans can make it happen.

- Purchasing Furniture, Fixtures, and Supplies: Outfitting your business with the necessary equipment and furnishings is essential for functionality and aesthetics.

- Changes of Ownership (Complete or Partial): Whether you're buying a business or selling part of yours, 7(a) loans can facilitate these transitions.

- Multipurpose Loans: You can use 7(a) loans for any of the above purposes or a combination of them.

Key Benefits of SBA 7(a) Loans

1. **Higher Loan Amounts:** The maximum loan amount for a 7(a) loan is $5 million, making it suitable for a wide range of business needs.

2. **Competitive Interest Rates:** These loans typically offer lower interest rates compared to traditional bank loans, which can significantly reduce your borrowing costs.

3. **Longer Repayment Terms:** 7(a) loans often come with longer repayment periods, giving you more time to pay back the loan without straining your cash flow.

4. **Flexibility:** The program's versatility allows you to choose the loan terms that best fit your business's unique needs.

Eligibility Factors

To qualify for a 7(a) loan, your business must meet certain eligibility criteria, including what your business does to receive its income, its credit history, and where it operates. The SBA works with a network of approved lenders, so you'll need to find a participating lender and go through their application process.

Empowering Black-Owned Businesses

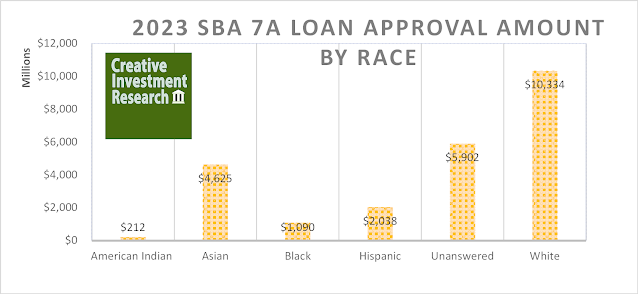

The SBA is committed to fostering diversity and inclusion in the small business ecosystem. Recent data shows significant growth in 7(a) loans to Black or African American-owned businesses.

In 2023, over 4,000 loans were approved for Black businesses, totaling more than $1 billion, compared to $599 million in 2017. This underscores the performance in supporting Black and minority entrepreneurs.

Conclusion

The SBA's 7(a) loan program can be a game-changer for small businesses, providing access to capital for growth, innovation, and resilience. If you're a small business owner looking to take your enterprise to the next level, exploring the benefits of 7(a) loans is a smart move. It's not just about getting a loan; it's about unlocking your business's full potential and contributing to a thriving economy. Combines with assistance from the MBDA, these programs can really help your business grow.

The SBA 7(a) loan program is a testament to the federal government's commitment to supporting small businesses and promoting economic diversity. So, take that next step, explore your options, and embark on your journey to financial success with the help of SBA 7(a) loans. Your business and the economy will thank you.